Introducing OpenPAYGO Pass

We are pleased to introduce OpenPAYGO Pass, the latest open-source innovation created by SolarisLab in conjunction with the EnAccess Foundation, in an effort to enhance the customer journey for end users of Pay-as-you-go (Paygo) products and services living in areas where Mobile Money (MoMo) is not available, while allowing last-mile distributors (LMDs) to collect valuable usage data, through affordable RFID tags and a free mobile app.

Overview

OpenPAYGO Pass is a joint development between longtime collaborators SolarisLab and EnAccess, fitting comfortably into the OpenPAYGO™ Suite of technologies to help the solar industry move closer to achieving the sustainable development goal of providing widespread access to clean and affordable energy (SDG7). The idea behind this exciting open-source tool is to allow end-users residing in geographic areas where MoMo connectivity is low or unavailable, to have a seamless Paygo experience through the use of radio frequency identification (RFID) cards, as currently users in such areas have to undergo a time consuming and inconvenient process to activate their Paygo devices.

The need for OpenPAYGO Pass

Paygo has proven necessary to unlock energy and essential services to more than 400 million people within the 1.8 billion unbanked population worldwide. The Mobile Money sector has been a crucial piece in that success, enabling the infrastructure for customers to pay for goods and services within reach of a simple mobile transaction, saving time for Paygo operators as well, who now do not necessarily have to collect cash. GSMA reports suggest that Paygo customers are considered high-value customers for the MoMo sector and drive revenue for mobile operators, as the use of MoMo for Paygo repayments also propels users to engage in other MoMo-enabled transactions and services.

However, there are still territories in the world where MoMo service providers don’t operate or remote regions where Paygo providers are yet to integrate with MoMo, where end users of Paygo products and services must go through a cumbersome process to make their corresponding repayments. The solution for customers in these areas is to write down the serial number of their Paygo device on a piece of paper, go to the nearest kiosk, make the payment in cash and hand the sequence of numbers to the agent, who will then write a token on a piece of paper that the customer will take home to use for Paygo activation, a clearly error-prone, time-consuming and risky process that also prevents distributors from obtaining important usage data.

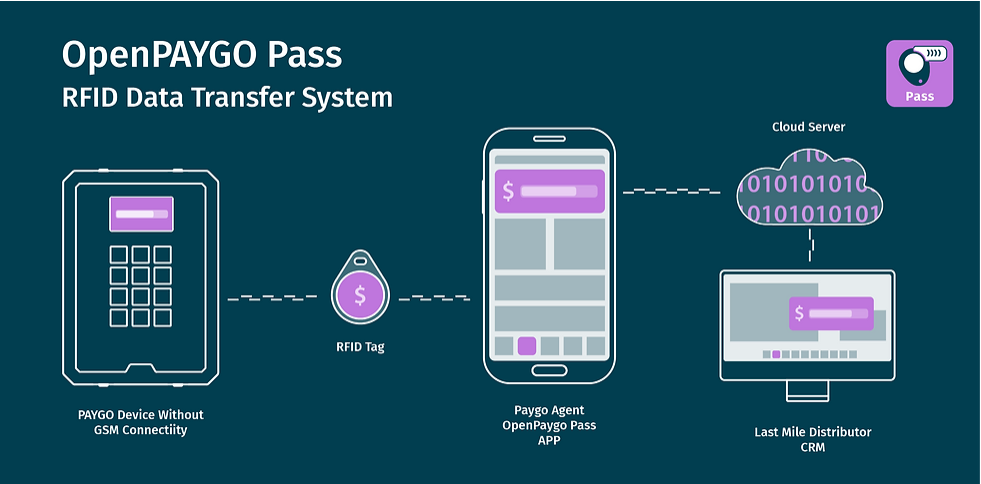

OpenPAYGO™ Pass aims to significantly improve this process for the end user, while allowing distributors to collect usage data via an RFID tag. With this solution, the end user will tap the tag on the Paygo device before going to the kiosk to pay, tap it at the kiosk after paying, and tap it again at home to activate the device and continue enjoying energy and other services.

The solution relies on affordable-cost RFID readers (less than $1 USD) integrated within Paygo devices and RFID tags (approx, $0.01 – $0.5 depending on style) to be given to clients, allowing for an enhanced client journey and free data feedback. The other crucial component of OpenPAYGO™ Pass is a free mobile app, which the agent will use to load the tag with the corresponding Paygo token.

Similar mechanisms are leveraged by some utilities providers in Sub-Saharan Africa, without the data-retrieval component. OpenPAYGO Pass enables a cost-effective system to extend the benefits of Paygo products and services in areas without MoMo by enabling a much simpler and less error-prone customer journey, as well as a great opportunity to unlock results-based financing (RBF) for customers who are typically overlooked due to connectivity issues.

An Improved Customer Journey

The improved customer journey that OpenPAYGO™ Pass unlocks would be as follows:

1. The client goes to the nearest kiosk available to pay and presents the OpenPAYGO™ Pass tag

2. The agent collects the cash and taps the tag on the OpenPAYGO™ Pass mobile app. The app not only transmits the token activation code, but also receives usage data so that distributors can collect important usage feedback .

3. The client goes back home and taps the tag onto their device to keep enjoying the Paygo service.